JP Morgan Chase (previously First Republic) Business Information Form - instructions

JP Morgan Chase (previously First Republic) will request fund managers to fill out the business information form for each account - the fund account and the fund manager account.

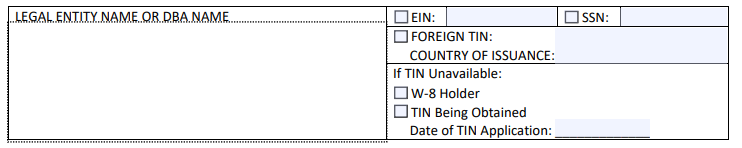

Form 1: Fill in Fund name as listed on formation document & EIN number

Form 2: Fill in Fund manager name as listed on formation document & EIN number

--------------------------------------------------------------------------------------------------------------------------------

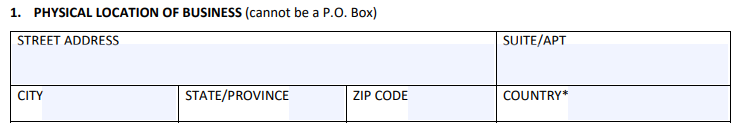

Question 1:

Form 1: Fill in Fund business address

Form 2: Fill in Fund manager business address

--------------------------------------------------------------------------------------------------------------------------------

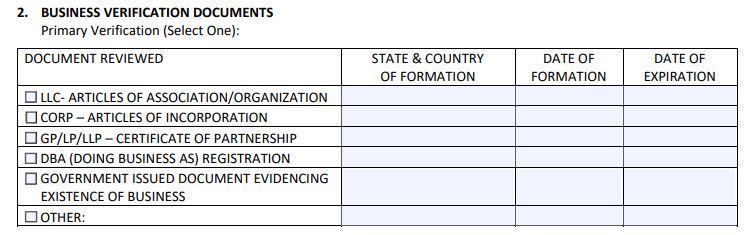

Question 2:

Form 1: Check LLC box, fill in state of formation & date of formation from your formation documents

Form 2: Check LLC box, fill in state of formation & date of formation from your formation documents

--------------------------------------------------------------------------------------------------------------------------------

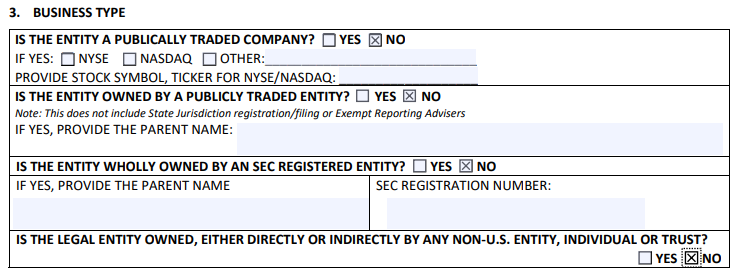

Question 3:

Form 1: Select No on Question 3 items.

Form 2: Select No on Question 3 items. This assume you do not have any non-US partners in the management entity.

--------------------------------------------------------------------------------------------------------------------------------

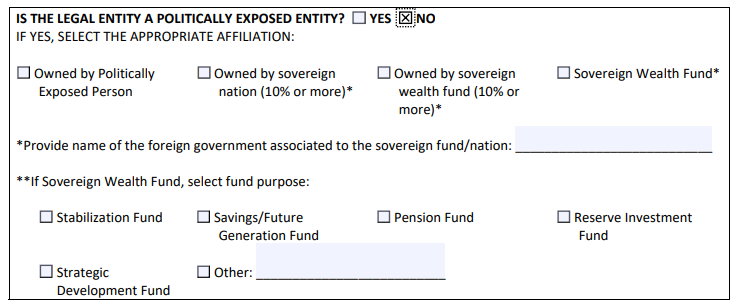

Form 1 & 2: Select No. Politically exposed persons are not permitted to start funds on Avestor's platform.

--------------------------------------------------------------------------------------------------------------------------------

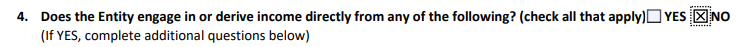

Question 4:

Form 1 & 2: Select No. Avestor does not support funds related to interest gambling, MRB businesses and e-sigarette/vaping related businesses.

--------------------------------------------------------------------------------------------------------------------------------

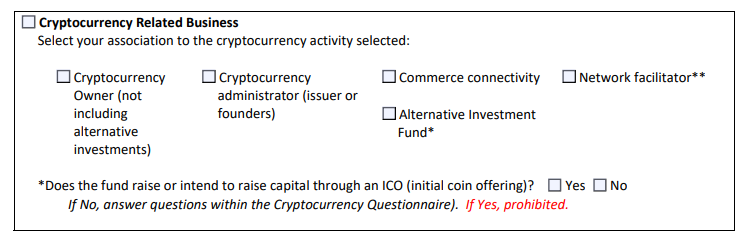

Form 1 & 2: If your fund will be investing in any type of investments that are related to cryptocurrencies, they will need to be disclosed to the bank.

--------------------------------------------------------------------------------------------------------------------------------

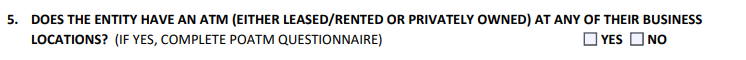

Question 5:

Form 1 & 2: Answer No

--------------------------------------------------------------------------------------------------------------------------------

Question 6:

Form 1 & 2: Include website for your fund.

--------------------------------------------------------------------------------------------------------------------------------

Question 7:

Form 1 & 2: Type Avestor as your referral source.

--------------------------------------------------------------------------------------------------------------------------------

Question 8:

Form 1: The business narrative should focus on the fund. See example below.

Form 2: The business narrative should focus on the fund manager entity. See example below.

Example of a good fund narrative:

Mandolin Real Estate Fund LLC is a real estate investment fund. Ms Benriner and Mrs. Oxo are the fund executives and the fund is operated as a fund of funds. The fund of funds deploys investments across multiple real estate asset classes that include multi-family, retail and hospitality and plan to grow the fund to $20-$30 million AUM. They seek assets where prior owners have failed to execute the property operations in a profitable manner and are in need to sell their investment. The fund will facilitate soft commits from their investors and then raise the capital to invest in the property. The typical transaction size for this is between $500,000 and $750,000 and active can occur at any time of the month.

Example of a good fund manager LLC narrative:

Mandolin RE Fund Manager LLC manages the Mandolin Real Estate Fund. Ms Benriner and Mrs. Oxo are the managing partners and share equally in day to day operational responsibilities of the fund. The manager LLC collects up to a 2% management fee from investors in the fund, collected on a monthly basis. The managers may also be sharing in distributions and profits associated with specific deals in the fund.

--------------------------------------------------------------------------------------------------------------------------------

Questions 9 & 10:

Form 1 & 2:

--------------------------------------------------------------------------------------------------------------------------------

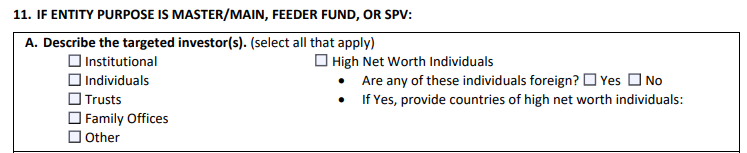

Questions 11:

Form 1: Check off all the investor types you will be targeting for your fund.

Form 2: Skip this question

Form 1: State USA only

Form 2: Skip this question

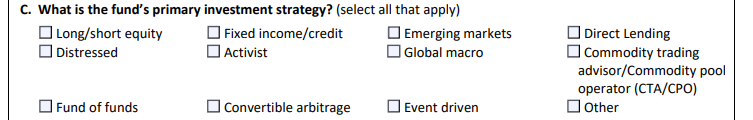

Form 1: Select Fund of funds, direct lending, or other depending of your fund's business model.

Form 2: Skip this question

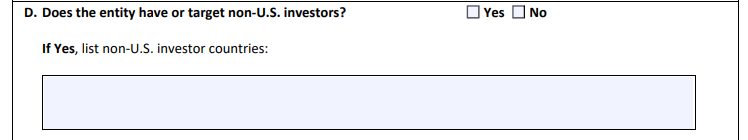

Form 1: Select No & skip rest of question.

Form 2: Skip this question

--------------------------------------------------------------------------------------------------------------------------------

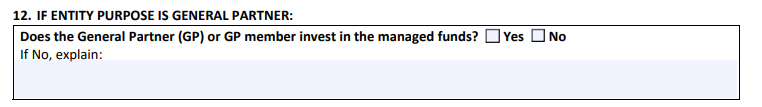

Question 12:

Form 1: Skip this question

Form 2: Answer Yes.

--------------------------------------------------------------------------------------------------------------------------------

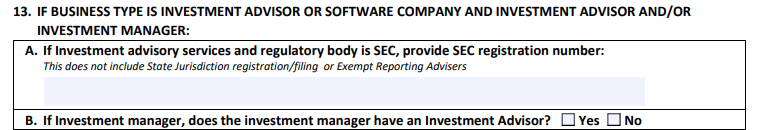

Question 13:

Form 1: Skip this question

Form 2: Skip 13A and 13B unless you are already registered as an RIA with SEC.

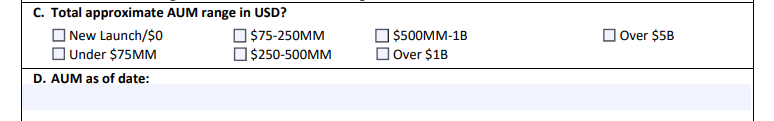

Form 2: For 13C & 13D, select New Launch/$0 and $0 AUM as of date unless you are using an existing manager entity and have other funds under management.

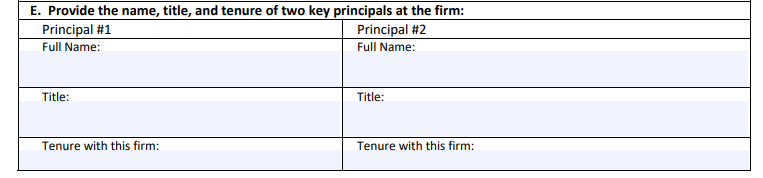

Form 2: For 13E, fill in the name of each manager in the management entity.

--------------------------------------------------------------------------------------------------------------------------------

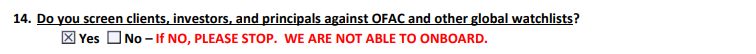

Question 14:

Form 1 & 2: Select Yes

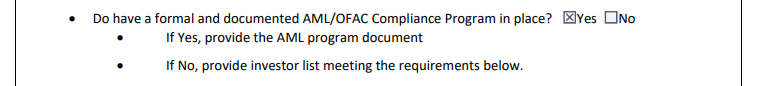

Check United States Department of the Treasury's Office of Foreign Assets Control (OFAC)

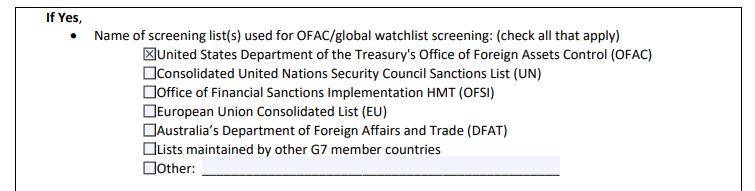

Select no to screening clients for negative news unless you are doing so.

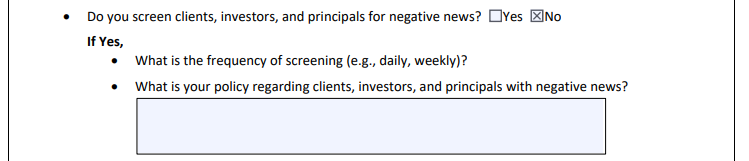

Select Yes and fill in box as shown below for Politically exposed persons

Select yes for a formal and documented AML/OFAC Compliance program. Avestor will provide you with the guidelines for the program.

Form 1: Keep empty for fund entity since new

Form 2: Fill in manager information for each person owning more than 25% of the fund manager LLC

--------------------------------------------------------------------------------------------------------------------------------

Question 15:

Form 1 & 2: Select No unless true & fill out details.

--------------------------------------------------------------------------------------------------------------------------------

Questions 16, 17, 18

Form 1 & 2: Select No.

--------------------------------------------------------------------------------------------------------------------------------

Question 19

Form 1 & 2: Put in the firm name of the attorney that is providing you service.

--------------------------------------------------------------------------------------------------------------------------------

Question 19

Form 1 & 2: Put in the firm name of the attorney that is providing you service.

--------------------------------------------------------------------------------------------------------------------------------

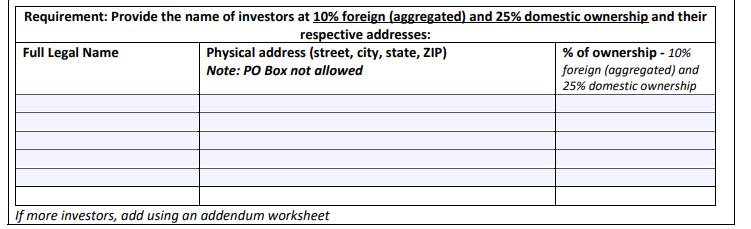

Question 20

Form 1 & 2: Select Fund of Funds and Other.

--------------------------------------------------------------------------------------------------------------------------------

Question 21

Form 1 & 2: Select No

--------------------------------------------------------------------------------------------------------------------------------

Questions 22 & 23

Form 1 & 2: Type in USA

--------------------------------------------------------------------------------------------------------------------------------

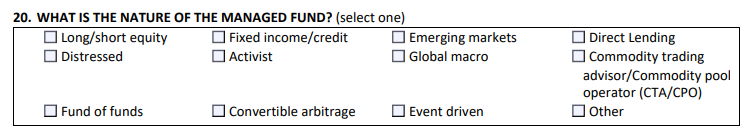

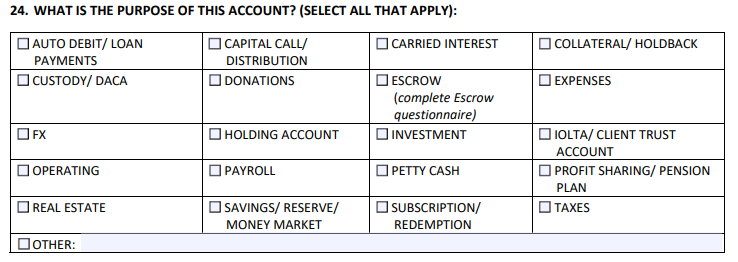

Question 24

Form 1: Select Real estate, Operating, Capital Call/Distribution, Investment, Expenses, Subscription/Redemption

Form 2: Select Investment, Carried Interest, Expenses

--------------------------------------------------------------------------------------------------------------------------------

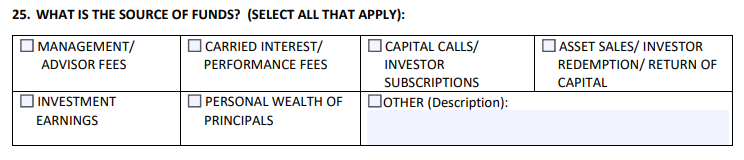

Question 25

Form 1: Select Investment earnings, Capital Calls/Investor Subscriptions, Asset Sales/Investor Redemption

Form 2: Select Management/Advisor fees, Carried Interest/Performance fees

-------------------------------------------------------------------------------------------------------------------------------

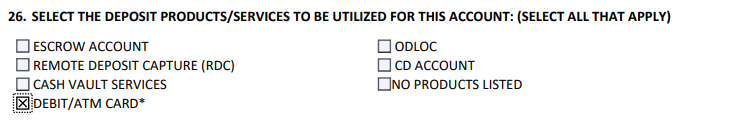

Question 26

Form 1 & 2: Select Debit/ATM Card unless you don't want one for the accounts

-------------------------------------------------------------------------------------------------------------------------------

Question 27

Form 1 & 2: State No

-------------------------------------------------------------------------------------------------------------------------------

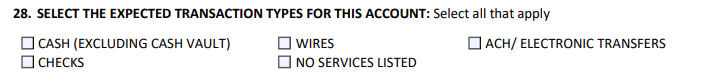

Question 28

Form 1 & 2: Select Checks, Wires and ACH

-------------------------------------------------------------------------------------------------------------------------------

Question 29

Form 1 & 2:

For Cash row, select None for deposits and withdrawals

For ACH and wires row, select the estimated total dollars per month and number of wires you estimate the account will see

-------------------------------------------------------------------------------------------------------------------------------

Question 30

Form 1 & 2: Describe in detail how money flow will occur in each account. See examples below.

Example:

Mandolin Real Estate Fund will deploy capital to underlying funds. Activity for the fund will occur throughout the month but typically the expectation is that between 1 and 20 wires will be sent each month, with each wire between $100,000 and $200,000. Because the investment strategy of the fund dictates that investments be made based as deals close, the wire volume could increase at random times of the month. These movements could also affect the size of the wires requested.