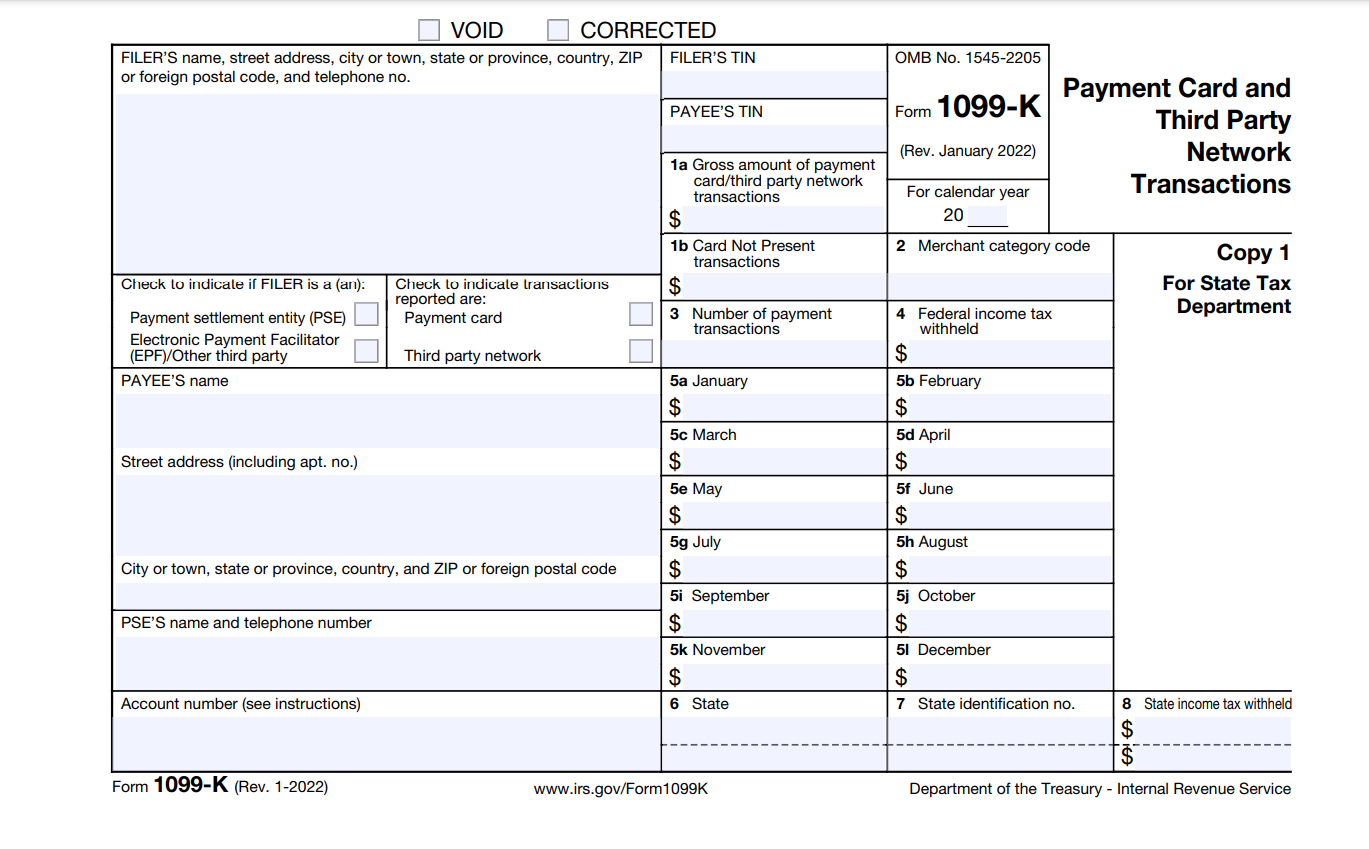

IRS 1099-K Forms - the in's and out's of them

If you are receiving notices about providing information for a 1099-K or have received a 1099-K, the following article will help you understand what it is.

The American Rescue Plan of 2021 introduced reporting requirements that any 3rd party payment processor that transfer funds over $600 in a calendar year must file an informational return to the IRS articulating the transfer of funds to that individual or entity.

The 1099-K DOES NOT REPORT TAXABLE INCOME. It is an informational return to the IRS only but is mandatory for payment processors to file this form for each end user where over $600 was transferred to them.

Starting in 2023, individuals that use Avestor's ACH system to transfer capital into/out of a fund may receive a 1099-K request for information to enable our 3rd party payment processor, Dwolla, to complete the 1099-K or they may receive the actual 1099-K form. If a request comes in for more information, the user must provide that information to Dwolla to comply with IRS rules. If they do not provide that service, their ACH capability will be disconnected and Avestor will not be able to facilitate the transfer of funds between the investor and the fund for that investor.